What every fleet owner should know about IRS 2290 filing and Schedule 1

What every fleet owner should know about IRS 2290 filing and Schedule 1

Blog Article

The IRS is always working to help improve the way taxes are filed and submitted. More and more people are choosing E-file to submit their taxes to the IRS. After an overwhelming response to E-filing in 2008 the IRS decided to improve this method of filing for 2010. Most of the accountant and CPA in New York and other cities have found it an easier way of filing taxes as it saves time.

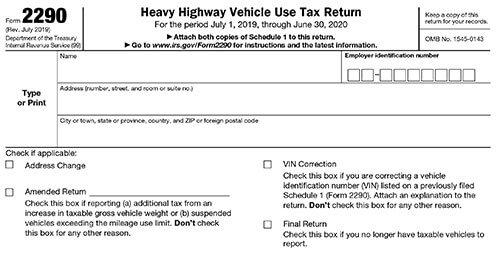

The best method for doing this is through the use of e-forms. These are now easily available on relevant websites. One such form is the 2290. Filling out the form is essential if you operate trucks on public roads. To ensure a quick filing of the necessary forms, there is now a facility for form 2290 tax form electronic filing.

Now the last, and simplest task. Find Form 2290 online a product or products. There are hundreds of products out there which you can offer to those people. Go sing up to Clickbank and get a free affiliate account, there are ebooks to promote, do a search in Google for fuel optimizer+affiliate and you get a result, or you sign up to neverblueads and get some lead programs who pay you for a simple submission (insurance or car loans), etc.

I have personally faced the devastating impact of a hit-and-run accident without having any physical damage. My vessel's driver side door and front tire had been smashed, and I had no physical damage coverage to clean up the mess. The combination of anger and heartache was dizzying. Truth be told, if I would've had the coverage to take care of it, I could have immediately brushed it off and still had a nice day. Instead my heart hurt for hours as I calculated the unfortunate damage to my truck. Never again. That's all I can say. Never again.

HHO is produced from plain old tap water. The water is held in a high temperature resistant reservoir. Most HHO systems use only around a quarter of a gallon of water, at most. Power is supplied by the IRS heavy vehicle tax's battery which passes an electric current through the water. An electrode contained within the receptacle or reservoir acts as a catalyst. Hydrogen bubbles away from the negative terminal while oxygen is generated from the positive terminal.

You can request either type of transcript by mail or by phone. The phone number is 1-800-829-1040. If you wish to request a transcript by mail you'll need the IRS address that pertains to your specific area. If you need a photocopy of a previously processed tax return request Form 4506 which is a Request for Copy of Tax Form.

The IRS has years of experience and teams of people working to ensure that the taxpayer is compliant and understands their legal obligation. That being the case you need to ask yourself this question: Is it worth the E-file 2290 risk to save a couple of thousand dollars when I go into the lions den? I assure you it is not. Whether you agree with the notion of charging someone for representation before the IRS, and whether you can afford it, is not the real question. The real question is can you afford not to?